How to reconcile Accounts Payable to General Ledger

Another example is matching inventory records in the general ledger with physical stock counts to ensure accuracy. Reconciliation serves a pivotal role in the accuracy and reliability of financial statements, which are essential for reporting a company’s financial health accurately. It ensures that financial records, such as balance sheets and income statements, are free from errors and discrepancies. To begin reconciling, one compares the transactions listed in the internal records, such as the cash book or accounting software, against the bank statement. The primary goal is to verify that balances match and all bank transactions, including payments and deposits, have been Law Firm Accounts Receivable Management recorded correctly.

Why You Should Automate General Ledger Reconciliation

- General ledger reconciliation is more than a routine task; it’s a safeguard.

- If you don’t reconcile your accounts payable properly, you could face late payments, duplicate payments, and incorrect payment amounts.

- In nowadays’ computerized world, the ledger is maintained in an electronic form.

- Sub-ledgers are presented in an electronic form as well (e.g. Excel file, detail of an account in QuickBooks, SAP or Oracle).

- Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

- Then check that each invoice has been entered into your accounts payable system properly.

- Finally, compare G/L balance to sub-ledger balance again, after all necessary adjustments were made.

To make sure the general ledger is reconciled, it is necessary to document and classify all transactions properly. This involves looking at bank statements, invoices, receipts, and other documents to make sure they match the entries in the ledger. If there are any differences or mistakes, they must be identified and fixed immediately to keep accurate financial records. Start by collecting all necessary financial documents and source materials. This includes bank statements, credit card statements, invoices, receipts, and any other records that reflect financial transactions.

Types of general ledger reconciliation

- Once the reconciliation is complete, it’s crucial to have another party, such as a manager or supervisor, review and approve the reconciliation.

- In this way, the solution is setup so that the GL account will tie to fixed assets.

- First and foremost, make sure you review your policies for each account you have.

- This agility helps you stay ahead of potential issues and capitalize on opportunities as they arise.

- For example, you may need to record accrued expenses or write off bad debts.

- At that time, someone can make a direct FI posting to the account, then go back and re-activate the reconciliation indicator as if nothing ever happened.

It makes sure all financial transactions are correctly recorded and businesses can easily understand their finances. Ledger in accountancy means a book in which accountants note down details of transactions. So, a general ledger is the book that records all the financial transactions conducted during business operations within a specific time period. Today, we use digital general ledgers, either as a general ledger reconciliation standalone spreadsheet, or as part of an enterprise accounting application. After the reconciliation is complete, review the process to identify any systemic issues that could be improved to prevent similar discrepancies in the future. Schedule regular follow-up reconciliations to ensure ongoing accuracy of the general ledger and to maintain financial integrity.

- General ledger reconciliation is more than a best practice; it’s a cornerstone of accurate financial reporting and sound financial management.

- The process of reconciling the general ledger in any business is open to various challenges.

- Hopefully the problem has been determined and the proper General Ledger account(s) can be debited or credited in General Ledger, Main, General Journal Entry.

- This adds a layer of oversight, ensuring that nothing was missed and that the reconciliation process was carried out thoroughly and accurately.

- Adjust for any differences due to outstanding checks, deposits in transit, bank fees, or errors to attain a reconciled balance.

- Bank reconciliation is a specific process within the broader accounts payable reconciliation process that focuses specifically on your organization’s cash accounts and transactions.

- In large companies, the accounts department is required to take official approval of the management and other stakeholders before finalising the general ledger.

Preparation and Collection of Documents

While doing that, pay special attention to the transactions that are unusual in their nature. For instance, non-recurring transactions may have a higher risk of an error than transactions completed on recurring and regular basis. Then you should look at the cash receipts and cash payments journals (for receivables and payables, respectively). Possibly, you will need to repeat with your examination of the invoice register for accounts receivable and the purchase order journal for accounts payable. Within the balance sheet, equity accounts represent the shareholders’ stake in the company. They need to be reconciled to reflect transactions like issuing new shares or distributing dividends.

- Strong internal controls help you safeguard against fraud, unauthorized transactions, and financial mismanagement.

- For instance, non-recurring transactions may have a higher risk of an error than transactions completed on recurring and regular basis.

- Automated reconciliation processes provide real-time insights into your financial data, allowing for immediate visibility into your organization’s financial health.

- At every stage of a business, financial discipline plays a pivotal role in scripting the success story.

How often should I be doing accounts payable reconciliation?

Human error in data entry can lead to discrepancies that ripple through your financial records. Different accounts within your ledger income summary may require distinct reconciliation methods to ensure financial accuracy and compliance. The general ledger is the primary record of every financial transaction your company makes, from revenue and expenses to assets and liabilities.

Even with an efficient, established process, AP reconciliation can be challenging. Especially when you’re potentially dealing with dozens of vendors and even more bills. So attention to detail is absolutely vital to avoid errors that could cost you time, money, or even your business. Once you’ve resolved all discrepancies, go back over your records to make sure everything is complete and accurate. Then finalize the process by writing a report summarizing your findings and start obtaining any approvals necessary to make further changes.

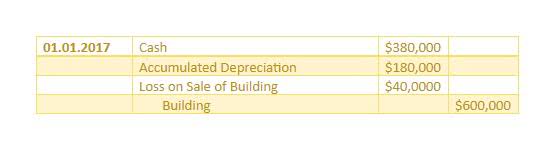

Correcting Accounting Mistakes

The majority of the time, either someone got cute and opened up a backdoor (the recon indicator) to make a posting, or the data was never converted accurately. Compare this report to the YTD ledger for the Customer Cash Receipt account. See Section 2 above for steps on how to run the YTD ledger using necessary prefix conditions and/or ranging on the customer deposit account. First and foremost, make sure you review your policies for each account you have. To reconcile, you would adjust the bank amount to account for the deposit they have not recorded yet, arriving at $6,780.